Acquisition and Transfer of Immovable Property in India

-

Person of Indian Origin (PIO)

- Purchase of immovable property

- Gift/ Inheritance of immovable property

- A PIO may acquire any immovable property (other than agricultural land/ plantation property / farm house) in India by way of gift from a person resident in India or a NRI or a PIO

- A PIO may acquire any immovable property in India by way of inheritance from a person resident in India or a person resident outside India who had acquired such property in accordance with the provisions of the foreign exchange law in force or FEMA regulations, at the time of acquisition of the property

- Transfer of immovable property

- Payment for Acquisition of Immovable Property in India

- By way of purchase out of funds received by inward remittance through normal banking channels or by debit to his NRE / FCNR(B) / NRO account

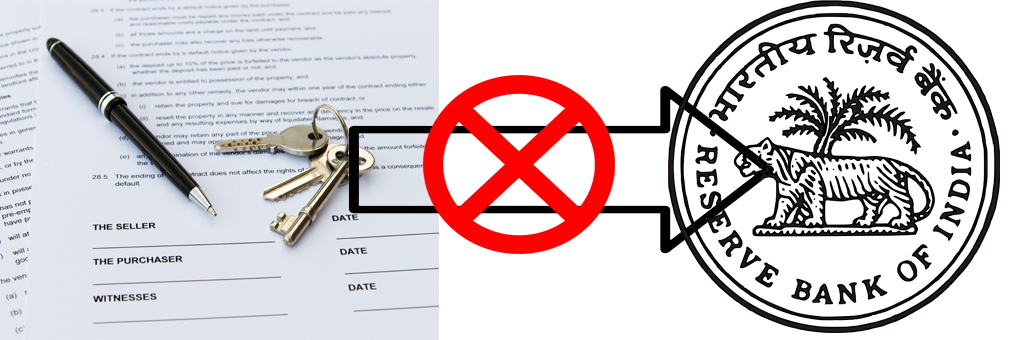

- Such payments cannot be made either by traveller's cheque or by foreign currency notes or by other mode other than those specifically mentioned above

- A PIO who has purchased residential / commercial property under the general permission, is not required to file any documents with the Reserve Bank

A PIO can acquire by way of purchase any immovable property (other than agricultural land/ plantation property / farm house) in India.

"Other than agricultural land/ plantation property / farm house"

"Other than agricultural land/ plantation property / farm house"

A PIO can transfer any immovable property in India (other than agricultural land / farm house / plantation property) by way of sale to a person resident in India. He may transfer agricultural land / farm house / plantation property in India, by way of gift or sale to a person resident in India, who is a citizen of India. He may also transfer residential or commercial property in India by way of gift to a person resident in India or to a person resident outside India, who is a citizen of India or to a Person of Indian Origin resident outside India.

"Other than agricultural land/ plantation property / farm house"

A PIO can make payment for acquisition of immovable property in India (other than agricultural land / farm house / plantation property):

"Other than agricultural land/ plantation property / farm house"