Acquisition and Transfer of Immovable Property in India

Non- Resident Indian (NRI)

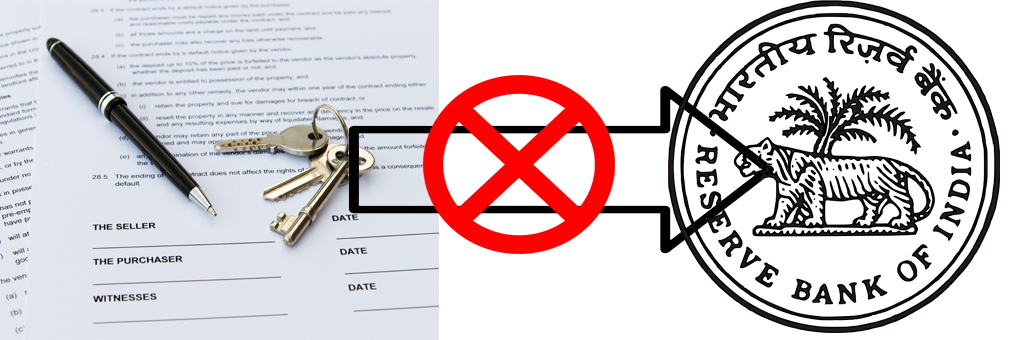

- Purchase of immovable property

- Transfer of immovable property

- A NRI may transfer any immovable property in India to a person resident in India

- He may transfer any immovable property (other than agricultural land or plantation property or farm house) to an Indian Citizen resident outside India or a PIO resident outside India

- Payment for Acquisition of Immovable Property

- Funds received in India through normal banking channels by way of inward remittance from any place outside India or by debit to his NRE / FCNR(B) / NRO account

- Such payments cannot be made either by traveller's cheque or by foreign currency notes or by other mode except those specifically mentioned above

- A NRI who has purchased residential / commercial property under general permission is not required to file any documents with the Reserve Bank.

A NRI can acquire by way of purchase any immovable property (other than agricultural land/ plantation property / farm house) in India.

"Other than agricultural land/ plantation property / farm house"

"Other than agricultural land/ plantation property / farm house"

NRIs can make payment for acquisition of immovable property (other than agricultural land/ plantation property / farm house) out of:

"Other than agricultural land/ plantation property / farm house"